DECEMBER 2023

In this issue

Click a heading to reach that section or just scroll through.

HAPPY HOLIDAYS FROM BLUE HAWK!

BLUE HAWK RETIREMENT – A Retirement Plan for the 21st Century!

HEALTH INSURANCE CAPTIVE – Top 10 Benefits of a Captive

THE DASHBOARD – 2023 shows a tremendous increase in use

BENCHMARK BLUE – Productivity for the win!

FILL IT NOW – Your private, inventory-sharing website

2023 FALL ADVISORY FORUM RECAP

2024 ANNUAL CONFERENCE – Mark your Calendars

NEXTLEVEL LEADERSHIP PROGRAM – Sign up today!

BLUE HAWK UNIVERSITY – BHU fourth quarter stats

Happy Holidays from BLUE HAWK!

A Retirement Plan for the 21st Century

In today’s hyper-competitive economy, retirement plans are critical when recruiting and retaining employees. But having a good retirement plan is not enough – you need a GREAT plan. And WE have one!

- Our plan keeps growing.

- The assets within the BLUE HAWK Retirement Plan have grown from $1m in 2016 to $80m in 2023.

- We are a big deal.

- The addition of IMARK Plumbing and Electrical has resulted in our retirement plan being one of Lincoln Financial’s largest group 401(k) plans.

- This means we’re very important to their bottom line, and therefore have more leverage with them when negotiating for better service and lower fees. — Simply put, Lincoln Financial (a Fortune 250 company) is paying attention to BLUE HAWK and One Member Retirement. Members who are participating are part of something BIG.

- Lincoln Financial has your back.

- Retirement plans are governed by a complex set of rules and regulations that are constantly changing. It’s far too easy for employers to unintentionally fall out of compliance and become liable for errors — simply because the plan is so complex. When you join the BLUE HAWK Retirement plan, Lincoln looks for errors and corrects them to protect your business from that liability.

________

*A time horizon as an investment objective at an approximate date when an investor plans to start withdrawing their money. Such portfolios generally have more equity securities early and more income securities later to reduce risk, volatility and return potential moving toward the target date. The principal will fluctuate and is not guaranteed at any time including the target date.

Andrew Thompson and Andrew Seaborg are registered representatives of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies.

Learn More About BLUE HAWK Retirement

SCHEDULE A VISIT with Andrew Thompson to learn more about the value BLUE HAWK Retirement delivers, and see how making the switch can benefit your business.

After all, you deserve a great retirement plan.

Check out this video to learn more about the value of group 401(k) plans.

______________________________________

______________________________________

For more information contact:

Andrew Thompson

The Capital Group

608-268-5100

andrew.thompson2@LFG.com

Meet with Andrew

Top 10 Benefits of a Captive

- Decrease risk and healthcare spend by paying claims as they are incurred instead of a fixed, fully-insured rate, that rises year over year.

- Greater transparency and improved data on actual claims cost and utilization.

- No new lasers for members.

- Unparalleled protection with renewals consistently below industry averages.

- Increased flexibility with plan designs, administration, and offered services, so employers can better support employees and spend wisely.

- Stronger stop-loss protection.

- Access to and assistance with an integrated cost management platform.

- Members rewarded with good experience.

- Seamless transition from a fully-insured model to a captive model for employees, with human resources and finance departments managing administrative changes on the backend.

- Elimination of the surprise of premium increases — helps CFOs smooth forecasting and plan budgets.

Click here to download Pareto’s most recent WhitePaper: Transforming Employee Health Benefits. Included in this document are the views of CFOs and industry experts on how the finance function can play a leading role in transforming employee health plans in a way that can reduce costs, while maintaining the plan quality essential to achieving business objectives.

For more information contact:

Dee VanSchoick, Jr.

Managing Director | CA License #0E09823

Risk Strategies

dvanschoick@risk-strategies.com

2023 shows tremendous increase in use of The Dashboard from both Members and Vendor Partners

Now that the effects from Covid have started to mellow our industry is settling into a new normal — leaving Members with time to be proactive again. The Dashboard plays an integral role in your company being proactive with making smart inventory purchases and taking ownership over the rebate earning process. On the site, you can find YTD purchase amounts by Vendor Partners, rebate dividend earnings by program, rebate earning estimates through conversion opportunities, and more!

Jessica Jones and Aaron Claycomb from Tredence, have been reaching out to Members all year to highlight the benefits and features of this innovative rebate analytics system. As a result, we have received tremendous feedback from Members just like you who have been logging into the site regularly to ensure they don’t miss rebates in 2023. If you would like a tour of how to best use the site, don’t hesitate to reach out to Jessica today!

Also, keep in mind that your 2023 uploads need to be completed as close to year end as possible to ensure your company gets the maximum possible Annual Scorecard points and to avoid having to complete the manual Purchasing Survey due in March.

___

For more information or to schedule a tour, contact Jessica at jjones@bluehawkcooperative.com or 480-499-4426.

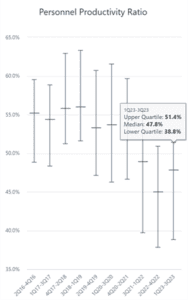

Productivity for the win!

Benchmark BLUE participants are holding on to higher-than-average bottom lines despite a significant slowdown in sales growth combined with gross margins returning to “normal.” Personnel productivity is the big driver.

One of our favorite metrics at CoMetrics is the Personnel Productivity Ratio (aka PPR). It measures how much of your gross margin you invest in people. So, if you have a 30% gross margin and spend 15% of sales on people, your PPR would be 50% (15% is half of 30%). So, lower is better, and that’s what we are seeing in the Benchmark BLUE data:

- The median PPR came in at 45.4% in the third quarter, which brought the year-to-date PPR (January through September) to 47.8%. Historically, median PPRs were between 54% and 58% (2016 through 2020), so mid-40s is a huge win for the group, especially given recent gross margin compression…

- Speaking of… the median Gross Margin has declined to 26.9% over the past six months (April through September) as compared to 28.5% and 28.6% in 2021 and 2022, respectively. As margins return to historical averages, this puts upward pressure on the PPR (which is a “bad” thing).

- A slowdown in Sales Growth does not help either. Year-to-date (January through September), most Benchmark BLUE participants experienced negative sales growth.

- Inventory levels remain elevated, but are coming down. The third quarter ended with a median Days Inventory on Hand of 118 days. Still, high as compared to ~100 days, which was more typical before 2020.

For more information on Benchmark BLUE:

Paul Giudice

paul@cometrics.com

857-472-4711

FILL IT NOW inventory-sharing website is the place to be

Fill It Now launched in September in partnership with IMARK Plumbing. This innovative, private B2B inventory-sharing website was designed to leverage the scale of our two verticals to help Members compete against national chains such as Lowes, Grainger, Watsco, and Ferguson. The site already has more than 45,000 SKUs available with more added daily. As a buyer – you can procure products you don’t normally stock without ever having to add SKUs to your warehouse. As a seller – you can increase sales without increasing expenses or commission costs.

Support your fellow cooperative Members by becoming an active Fill It Now participant. You’ll not only help increase the scale of our two verticals and gain access to hard-to-source parts/equipment, but you will increase your customer’s spend and loyalty, and so much more!

BLUE HAWK and IMARK Plumbing believe this initiative will give our combined 750+ Members (with 2,700+ locations) a competitive advantage in this ever-changing market. Additionally, the Fill It Now site has been so well received that it generated several accolades from our valued Vendor Partners upon creation.

If you have questions, please reach out to BLUE HAWK Director of Operations Jessica Jones or Marven Shook of the MarketPush team. We would be happy to help you and your team navigate the site and start utilizing it today!

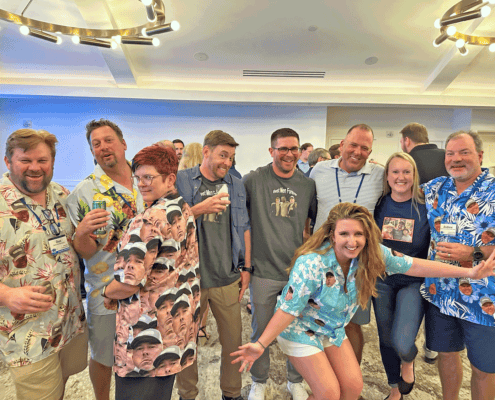

2023 FALL ADVISORY FORUM

The 2023 BLUE HAWK Fall Advisory Forum at PGA National Resort was a huge success. Great networking, an insightful presentation from Mark Lorenzo of Texas A&M, deep sea fishing, kayaking, pickle ball, and course, the only slightly competitive BLUE HAWK Cup Golf Tournament. Shout out to Team BLUE — after a five-year drought — on their big tournament win!!

Thank you to all our Members, Vendor Partners, Alliance Partners, and Solution Partners who attended and made the event so memorable. The ability to build strong business relationships in a relaxed atmosphere is what it’s all about. Thank you to our overall event sponsor, Nidec/U.S. Motors, and all additional event sponsors. The Fall Advisory Forum would not be possible without your support.

THANK YOU to all our Fall Advisory Forum Sponsors

DOOR PRIZE SPONSORS

- AireForce Inc.

- Aspen Manufacturing

- CertainTeed

- DiversiTech

- Enerco Technical Products

- FTL Finance

- Gray Metal Products, Inc.

- Harris Product Group

- Intermatic, Inc.

- Legend Valve & Fitting

- Mueller Streamline

- Neuco

- Nidec / U.S. Motors

- Nu-Calgon

- Omegaflex

- Rectorseal / TRUaire

- Resideo

- Schwank USA Inc.

- The Beringer Group

- Thermo Manufacturing

- Turbo Air

- UEI Test Instruments

- Ultravation, Inc.

- Velocity Boiler Works

BLUE HAWK Social Media