MARCH 2021

Better Benefits, Better Rates

Welcome to captive insurance.

IMARK Group now has a medical insurance option to provide relief to Members who face ever-increasing healthcare costs. Members of BLUE HAWK, IMARK Electrical, and IMARK Plumbing can now take advantage of the IMARK Group Health Insurance Captive, which is part of the oldest and largest medical captive in the U.S. This captive gives IMARK Group the same purchasing power, claims cost containment, and clout as a Fortune 100 company.

We know you’re busy with running your business right now, but summer into early fall is the best time to explore changing your insurance if you have an end of year renewal. This will give you time to explore your options and get everything in place before your renewal.

The IMARK Group Health Insurance Captive is a great alternative that can help save your company money, but still give your employees great coverage or maybe even better than what you have currently.

A captive is an insurance company whose purpose is to assume risk on behalf of its owners. Conceptually, captives bring together a group of like-minded businesses that pool their dollars into a collective fund. By doing so, a captive can:

- Greatly reduce the volatility that mid-sized clients would face if they were self-funding on

their own - Use collective buying power to build benefit programs that rival most Fortune 500 companies

In practice, captive members contribute anywhere from 15% to 35% of their total healthcare spend for large and catastrophic claims via premiums to the stop-loss carrier and captive. The captive or carrier then pays the large claims, and employers use the rest of their healthcare spend to pay for their broker, their third-party administrator, and any smaller, more predictable claims. If the captive runs better than expected, the employer receives their share of the profits. If the smaller claims don’t happen, then the money never leaves their control. That’s self-funding, with less volatility

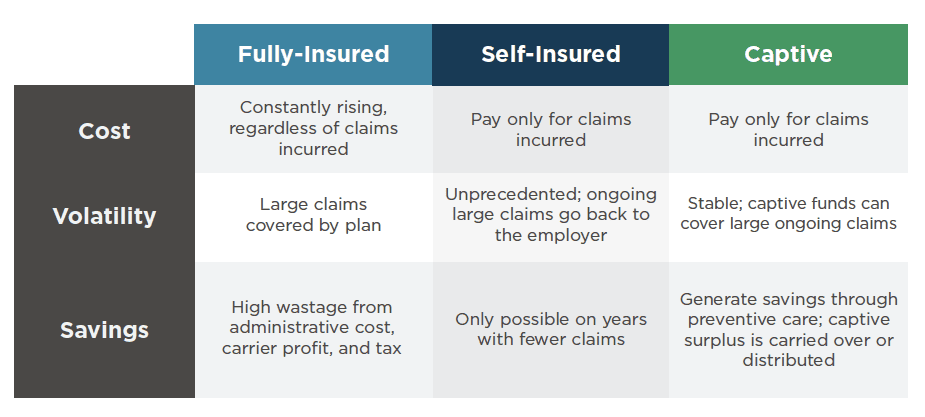

An important part of an effective captive structure is the use of cost containment programs by employers. Pareto’s portfolio includes an array of integrated solutions and strategic resources, including better pharmacy benefit manager contracts, an on-staff clinical pharmacist, Medicare & COBRA participation optimization, specialty networks, care coordination services, cancer support, clinical prior authorization review, and access to population analytics and intelligence (to name a few). These programs help both improve the overall health of employees and reduce aggregate claims made to the employer, generating significant savings for members in the long run. Comparing the pros and cons of captive insurance with the pluses and minuses of existing insurance models clearly reveals which is the better healthcare option:

For more information or to take advantage of this amazing program complete this form or contact:

Dee VanSchoick, Jr.

Managing Director

Risk Strategies Company

dvanschoick@risk-strategies.com

936-582-5205

![]()