JUNE 2023

In this issue

Click a heading to reach that section or just scroll through.

CEO’S MESSAGE TO BLUE HAWK STAKEHOLDERS

BLUE HAWK RETIREMENT – Retirement plan participants deserve high-quality investment menus

THE DASHBOARD – Get on board The Dashboard!

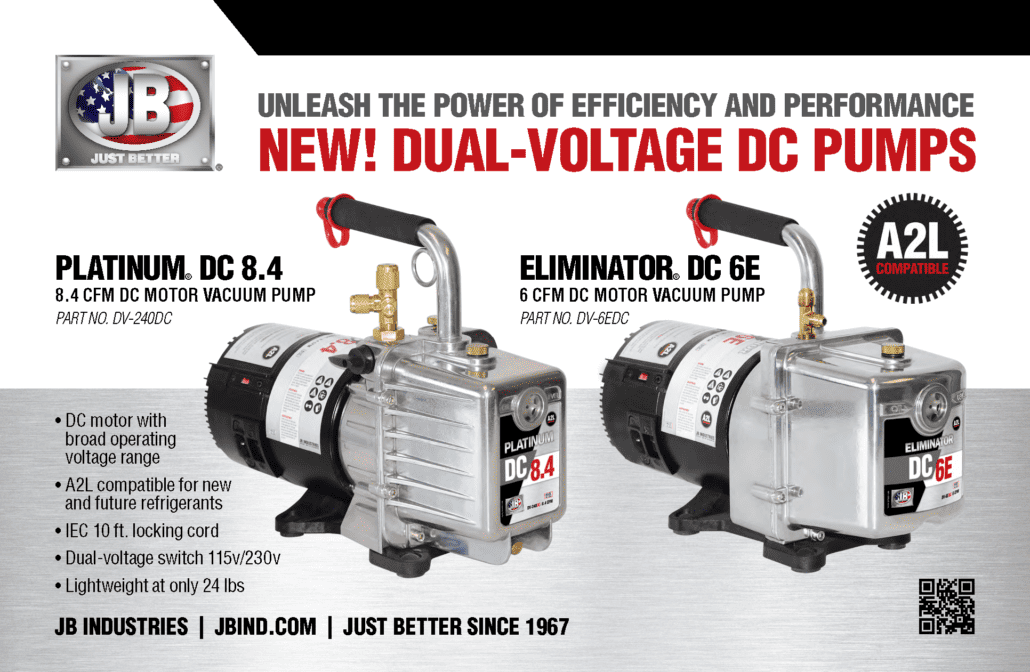

VENDOR PARTNER SPOTLIGHT – JB Industries

BENCHMARK BLUE – More inventory

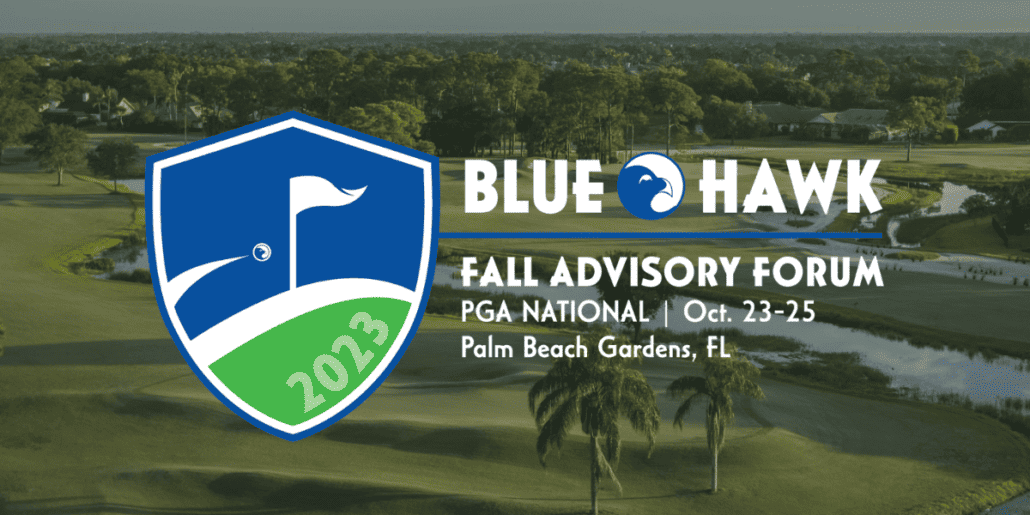

2023 FALL ADVISORY FORUM – Join us in Palm Beach Gardens, Florida

2023 BLUE HAWK CONFERENCE RECAP & AWARDS

BLUE HAWK GIVES BACK 2023 – Lifeworks Austin

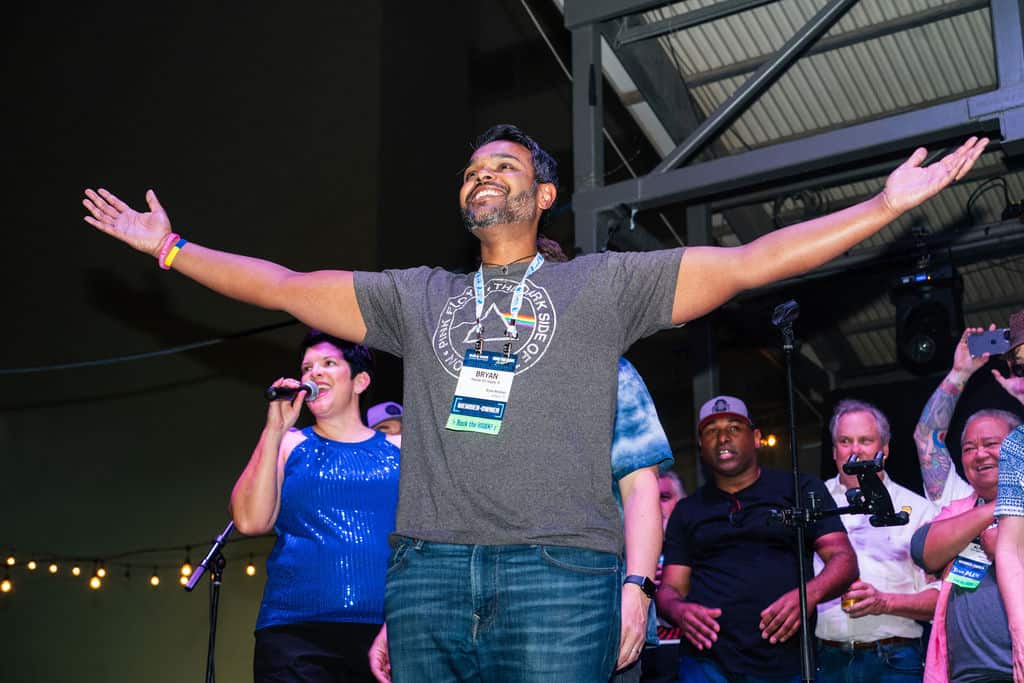

ROCK THE HAWK – Battle of the Bands recap

BLUE HAWK UNIVERSITY – BHU second quarter stats

RANTALA WINS CCA AWARD – 2023 CEO Outstanding Communicator

CEO’s Message to BLUE HAWK Stakeholders

Dear BLUE HAWK Community,

I hope this letter finds the start of the summer going well. Seeing most of BLUE HAWK’s 196 Members, 132 Vendor Partners, and 66 Alliance and Solution Partners at our 18th Annual Conference in Austin last month was a pleasure. BLUE HAWK Members had productive Peer-2-Peer Sessions and collectively more than 5,200 Vendor Partner Face-to-Face Meetings. These interactions have always been instrumental in fostering growth and collaboration within our cooperative model and remain a top-rated portion of our conference according to survey results.

Our Vendor Partners have received outstanding feedback regarding BLUE HAWK Members’ proactive approach to shifting the share from unapproved suppliers. Your willingness to cooperate and support the only financially transparent co-op or buying group in the HVACR industry is commendable. Together, we are forging more robust partnerships and solidifying our market-leading position.

I want to express my appreciation for your continued dedication and commitment to BLUE HAWK. Because of your hard work and contributions, we were able to return record-breaking patronage dividends in 2022. However, we must acknowledge the current economic forecasts, which have caused some uneasiness in the industry.

The competition among wholesalers has intensified, creating headwinds for our Members. Industry consolidation remains a persistent trend, with entities like Daikin, Ferguson, Trane, Watsco, and other large competitors actively pursuing acquisitions of independent businesses. In light of this, if you are considering selling your HVACR business, I encourage you to participate in the Growing Forward Acquisition Program. Currently, 35 BLUE HAWK Members are interested in acquiring HVACR businesses through this program. Growing Forward presents a unique opportunity for those looking to transition out of the industry while ensuring their legacy continues under the care of like-minded independent wholesalers.

BLUE HAWK is committed to providing you with the programs, services, and technology platforms necessary to navigate these challenging times. Together, we will overcome the obstacles that lie ahead and emerge stronger than ever.

Thank you once again for your unwavering support. The BLUE HAWK team is honored to serve our member-owned and fully transparent co-op, and we look forward to continuing this incredible journey with each of you.

GROW WITH BLUE!

Lance Rantala

BLUE HAWK CEO

Retirement Plan Participants Deserve High Quality Investment Menus

By Andrew Thompson, MBA

Retirement plans offered through one’s employer, such as 401(k), SIMPLE, or Profit Sharing Plans, are the most common way Americans invest – often it is the only account through which workers invest – and as such deserve more focused attention from employers who control access to the investment menu. Many American workers aren’t fortunate enough to have a retirement plan through their employer, but for those that are saving from their paycheck is only half the battle. Investment options can be overwhelming, complex, expensive, and outdated. Participants rely on those in positions of power to make intelligent and prudent choices regarding which investments are available.

The prudent business owner (or others responsible for the retirement plan), who has a fiduciary responsibility for the investment menu, ensures that the investments they choose to offer are high quality, sufficiently broad for participants to diversify their account while not being so broad as to overwhelm the participant, are low cost, and are regularly reviewed for a historic record of performance. Applicable rules and regulations, chiefly the Employee Retirement Income Security Act of 1974 (as amended by SECURE 1.0 and 2.0), define this relationship as fiduciary in nature. The courts see a fiduciary relationship as the highest legal standard to meet in the land.

Within the context of an investment menu meeting your fiduciary responsibilities includes careful attention to the above on a regular schedule. The investment menu should be reviewed at least annually, if not more frequently, and this review should follow the procedures included in your Investment Policy Statement – the written policy that lets participants know how you will construct and monitor the investment menu. (Pro tip: if you do not currently have an updated Investment Policy Statement, this should be the first thing you work on – it’s the first thing a government auditor is going to ask for.)

— Click below for full article —

For more information contact:

Andrew Thompson

The Capital Group

608-268-5100

andrew.thompson2@LFG.com

Meet with Andrew

________

This material is designed for informational or educational purposes only. Lincoln Financial Advisors Corp. and its representatives do not provide legal or tax advice. We encourage you to consult a legal or tax advisor regarding any legal or tax information as it relates to your personal circumstances.

Andrew Thompson is a registered representative of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC) and registered investment advisor.

Get On Board The Dashboard

So many of you reached out to a BLUE HAWK team member at the annual conference about The Dashboard. It was encouraging to feel the momentum building toward using The Dashboard to its full capabilities to better your business.

What’s holding you back?

For those not utilizing The Dashboard – we would love to hear how we can help you get started. Even if you don’t submit transactional data, your company still has access to a significant amount of useful data through The Dashboard. For example, by simply logging in, your company can manage your 2023 rebate targets for every Vendor Partner you purchase from. This data can be used for collaborative forecasting, QAQC rebate earnings, and to get the best ROI on everything from POs to rebate earnings!

Activate your company’s account in just three steps:

- Upload your transactional data.

- Map your column headers.

- Map your Vendor Partners.

Seem too easy to be true? It’s not!

- Worried your ERP can’t handle the transactional report? — We have worked with 29 ERPs including DDI, Epicor, and Quickbooks.

- Worried your data isn’t secure? — Tredence has top of the line security and runs 3rd party analysis to ensure data safety.

- Worried the process is cumbersome? — Once the transaction file is ready, the onboarding process is three simple steps.

- Worried the process is overwhelming? — Tredence will walk you through every step of onboarding.

Don’t let the momentum from our annual conference fade away, reach out Jessica Jones today.

For more information or to schedule a tour, contact Jessica Jones at jjones@bluehawkcooperative.com or 480-499-4426.

Vendor Partner Spotlight

Future-proof Your Pump with JB’s NEW A2L Compatible Vacuum Pumps

Get the best of both worlds with the NEW DC Motor Pumps from JB Industries. These lightweight, dual voltage pumps operate in low and high temperatures and feature a DC motor for use in low voltages. With their A2L compatibility and easy to switch 115v/230v supply, you can pull a deep vacuum on any system quickly & efficiently. Available in both a 6 CFM and 8.4 CFM model, enjoy the convenience of a DC motor, reliable operation, and American-made quality you’ve come to trust from JB!

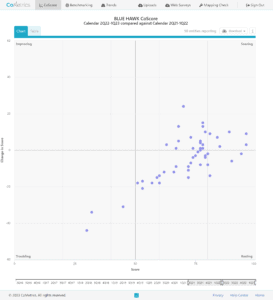

More Inventory!

We have a new median Days Inventory on Hand record:

We have a new median Days Inventory on Hand record:

- 148 days at the end of the first quarter. That’s almost five months’ worth of inventory – a ~50% increase compared to historical averages.

- While inventory grows, sales growth slowed to 4.9% in the first quarter, bringing profitability down as expenses continue to rise. Inflation appears to be having an impact on costs.

- For many members, the rise in interest rates is taking its toll on profitability. 25% of the group now pays over $75k per quarter in interest expense.

How did you do in the first quarter of 2023?

Check out the CoMetrics platform to see how you compare to your BLUE HAWK peers. Or Meet With Paul Giudice, CoMetric’s CEO, for a personalized tour of the data. Remember: Benchmark BLUE is available to all Members for no additional fee!

For more information on Benchmark BLUE:

Paul Giudice

paul@cometrics.com

857-472-4711

2023 Fall Advisory Forum Registration Opening Soon

Join us in Palm Beach Gardens, Florida, at PGA National for the BLUE HAWK Fall Advisory Forum on October 23-25, 2023. Monday afternoon will feature a BLUE HAWK update, Mini Face-to-Face Sessions and a welcome reception.

Tuesday, we will play 27 holes on The Match and Fazio courses, followed by 18 holes on Wednesday on The Palmer course. Both courses are onsite and part of the famous PGA National Resort.

For the non-golfers, we will have deep sea fishing adventures, kayaking/paddle boarding, a segway tour and a pickle ball activity including instructions for those who don’t know how to play this popular sport.

Don’t delay! Make sure to register as soon as it opens — Deadline is September 12, 2023.