SEPTEMBER 2019

CEO’s Message to BLUE HAWK Stakeholders

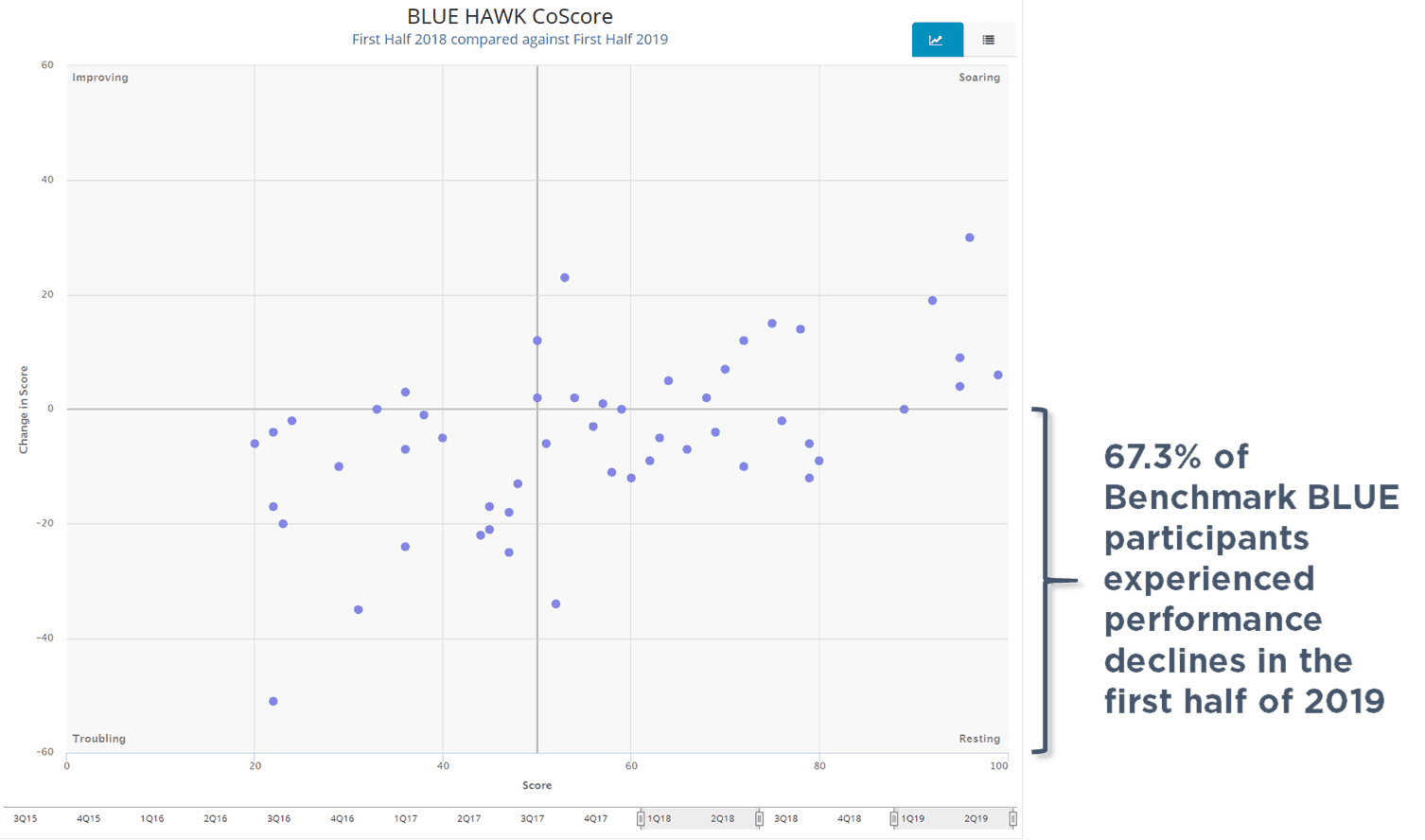

Two thirds (67.3%) of Benchmark BLUE participants experienced performance declines in the first half of 2019 as compared to the first half of 2018. As you can see in the CoMetrics’ CoScore, more dots (BLUE HAWK Members) are below the middle line vs. above:

So, what happened? The primary driver was a slowdown in sales growth — from 6.8% to 3.8% for the Typical distributor. However, despite slower top-line sales, the Typical distributor was able to manage through the slowdown and found increased productivity form their workforce and kept expenses low. Personnel productivity (i.e., how much of your gross profit you invest in people) declined — a sign of improved efficiency — while other expenses (i.e., occupancy, operations, sales & marketing, and administration expenses) remained generally flat as a percentage of sales. As a result, operating profit margins ticked up in the first half of 2019 from 3.1% to 3.9%.

This is a great sign as we head into a period of uncertain economic times. Benchmarks can provide valuable perspective when managing through a slowdown. It’s important to keep a gauge on the broader industry and group as you contemplate investments or expense reductions. It’s a fine line between increased efficiency and cutting to the bone.