SEPTEMBER 2023

In this issue

Click a heading to reach that section or just scroll through.

CEO’S MESSAGE TO BLUE HAWK STAKEHOLDERS

BLUE HAWK RETIREMENT – How much are you willing to risk?

HEALTH INSURANCE CAPTIVE – Reduce risk and lower costs with the right health benefits captive

THE DASHBOARD – Don’t miss rebates in 2023

BENCHMARK BLUE – Productivity for the win!

FILL IT NOW – Your private marketplace is open and ready to use

2023 VENDOR PARTNER SCORECARD RESULTS

2024 WINTER SUMMIT – Join us in Telluride, Colorado

2024 ANNUAL CONFERENCE – Mark your Calendars

BLUE HAWK GIVES BACK 2023 – Maui Strong

BLUE HAWK UNIVERSITY – BHU third quarter stats

CEO’s Message to BLUE HAWK Stakeholders

Dear BLUE HAWK Community,

As we enter the final quarter of 2023, we’re excited to share how BLUE HAWK Members can boost their savings and fuel growth through our Vendor Partner programs and our powerful rebate analytics tool, The Dashboard.

Why Convert Purchases to Approved Vendor Partners?

We understand that every dollar counts, especially in today’s competitive market. By converting your purchases from terminated and unapproved suppliers to our trusted Vendor Partners, you ensure the strength of BLUE HAWK and unlock significant savings.

Our Vendor Partners have been vetted and selected for their commitment to our financially transparent co-op model and unwavering dedication to the success of independent HVACR distributors. By choosing them, you minimize the fragmentation of our purchasing power and contribute to the collective growth of the BLUE HAWK stakeholders.

The Dashboard – Your Key to Growth Incentives

The Dashboard is more than just an analytics tool; it’s your gateway to maximizing savings. In the fourth quarter of 2023, we’re spotlighting The Dashboard’s capabilities to drive growth incentives like never before.

Here’s what you can expect from The Dashboard:

- Near real-time rebate tracking: Easily monitor your guaranteed rebates and growth goals so you know exactly where you stand.

- Conversion opportunities: Get personalized insights to optimize purchasing decisions and maximize rebate potential.

- Comprehensive reporting: Access detailed reports that help you understand your spending patterns and identify opportunities for savings.

By utilizing The Dashboard effectively, you’ll lower your cost of goods sold and tap into growth incentives that can propel your business to new heights.

Act Now for Q4 Success

As we head into the holiday season and prepare for the new year, there’s no better time to switch to our approved Vendor Partners and harness the power of BLUE HAWK. The sooner you act, the sooner you’ll see the benefits reflected in your bottom line.

Contact our dedicated BLUE HAWK team for more information on converting purchases to approved Vendor Partners and leveraging The Dashboard.

Together, we can make the fourth quarter of 2023 a season of unmatched savings and growth for BLUE HAWK.

We wish you a prosperous Q4!

GROW WITH BLUE!

Lance Rantala

BLUE HAWK CEO

How Much Are You Willing To Risk?

By Andrew Thompson, MBA and Andrew Seaborg, MS

One of the most important skills investors can develop is the ability to determine how much risk one is willing to take. The old adage “with no risk there is no reward” remains true for investors but being conscious of how much risk you’re taking – and when in your lifetime you’re taking it – is critically important to having success as an investor. Taking too much or little risk, at the wrong time in your life, can spell disaster for your portfolio.

How Do I Determine My Tolerance?

Understanding the amount of risk you’re willing to assume takes some serious and honest self-reflection. First and foremost: please stop listening to the success (or failure) others are having when investing. Much like most forms of social media, our friends and family (or strangers on the internet) tend to highlight their successes – less so their failures. This leaves most of us with a feeling of being behind or at least missing out on something. If this feeling persists, it can lead to some unhealthy risk taking in order to “catch up”.

Tune out the noise. What matters is how you are personally saving and investing, not what anyone else is doing.

— Click below for full article —

For more information contact:

Andrew Thompson

The Capital Group

608-268-5100

andrew.thompson2@LFG.com

Meet with Andrew

________

*A time horizon as an investment objective at an approximate date when an investor plans to start withdrawing their money. Such portfolios generally have more equity securities early and more income securities later to reduce risk, volatility and return potential moving toward the target date. The principal will fluctuate and is not guaranteed at any time including the target date.

Andrew Thompson and Andrew Seaborg are registered representatives of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln affiliates and other fine companies.

Reduce risk and lower costs with the right health benefits captive

Cost management has always been a priority for CFOs, but in the U.S. — at least for the foreseeable future — uncovering new sources of savings will likely dominate their agenda. Roughly 80% of U.S. senior finance executives expect greater-than-normal cost increases for months to come, according to Duke University’s latest CFO Survey.

Against this backdrop, rising healthcare costs in America will continue to drain corporate resources and the economy. The U.S. spends more on health care than any other country, and total spend as a percentage of gross domestic product (GDP) is increasing annually. For example, in 2018, health care comprised 17.7% of total GDP. By 2028, healthcare spending is expected to swell to 20% of total GDP, or $6.19 trillion. For most companies, healthcare benefits are one of their largest expenses, especially due to unpredictable price increases year over year.

In 2021, Industry Dive partnered with ParetoHealth, a provider of employee health benefits solutions, to survey senior finance executives and determine how employee health costs factored into their strategic planning process. Our findings revealed these executives’ priorities, when it comes to navigating the complex relationship between employee health costs, employee benefits, and meeting business objectives.

Click here to download a PDF outlining those results. We also present the views of CFOs and industry experts on how the finance function can play a leading role in transforming employee health plans in a way that can reduce costs, while maintaining the plan quality essential to achieving business objectives.

For more information contact:

Dee VanSchoick, Jr.

Managing Director | CA License #0E09823

Risk Strategies

dvanschoick@risk-strategies.com

Don’t Miss Rebates in 2023!

Recently, we reached out to each Member highlighting rebates that were missed in 2022 by just a few dollars. Don’t let that happen this year! Take ownership over the rebate dividend process with The Dashboard.

Track each rebate your company qualifies for this year with an easy-to-read table highlighting the proximity of reaching the incentive and clearly defines each incentive down to the dollar. If you or someone at your company has not connected with Jessica Jones or a member of Tredence to review how your company is currently tracking, please reach out as soon as possible.

Remember, rebates are calculated based on invoice date, so don’t wait until December to review The Dashboard!

In addition to the great insight The Dashboard provides, onboarding your company’s data will also help you save time and avoid errors by bypassing the manual Annual Purchasing Survey. Help your team and submit purchasing order transactional data to The Dashboard before the end of the year. Your team will thank you!

For more information or to schedule a tour, contact Jessica Jones at jjones@bluehawkcooperative.com or 480-499-4426.

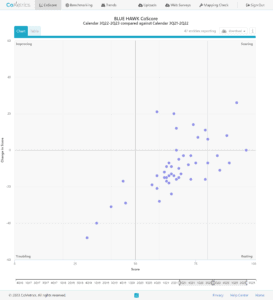

Productivity for the win!

As sales growth slows, BLUE HAWK distributors are realizing new efficiency gains. Personnel Productivity Ratio (aka PPR) is how much of your gross margin you spend on people. So, if you have a 30% gross margin (high, I know, but it makes the math easier) and you spend 15% of your sales on people, your PPR would be 50% (15% divided by 30%). So, lower is better.

Benchmark BLUE members historically averaged about a 56% PPR. Over the winter (Q4 2022 through Q1 2021), the median was 54% — close to the historical average. But, in the second quarter of 2023, the median PPR dropped to 42%. And that’s in the face of sales and margin declines for most. A nice win for BLUE HAWK Members!

How did you do in the second quarter of 2023?

Check out the CoMetrics platform to see how you compare to your BLUE HAWK peers. Or Meet With Paul Giudice, CoMetric’s CEO, for a personalized tour of the data. Remember: Benchmark BLUE is available to all Members for no additional fee!

For more information on Benchmark BLUE:

Paul Giudice

paul@cometrics.com

857-472-4711

FILL IT NOW is open and FREE for all BLUE HAWK Members

To gain a competitive advantage in the HVACR and plumbing space, BLUE HAWK and IMARK Plumbing have jointly developed a B2B Marketplace for our memberships. Together, we commissioned MarketPush, an experienced multi-vendor e-commerce creator, to develop and launch the all-new FILL IT NOW Marketplace — an impressive site exclusively for our Members.

As a seller, you will be provided with access to your own FILL IT NOW portal. This portal allows you to upload the products you want to make available to other Members. You have full control over setting up pricing, managing inventory levels, tracking orders, and overseeing shipment and delivery. It offers a comprehensive suite of features to streamline your selling process.

As a buyer, you will be provided with a login that grants you exclusive access to the FILL IT NOW Marketplace. The user-friendly site allows you to easily search, find, and purchase products to offer to your customers. It simplifies the process of expanding your product offerings without the need for extensive inventory investments.

Benefits of the FILL IT NOW Marketplace

A broader product availability. FILL IT NOW provides BLUE HAWK and IMARK Members with the ability to purchase products from fellow Members without having to add SKUs to your warehouse. There’s also the added bonus of:

- Supporting fellow Members instead of buying from an unaffiliated supply house,

- Access to hard-to-source parts and equipment, and

- Creating partnerships across the nation.

A larger customer base. This expansion of available inventory enables Members to provide a wider range of products to their existing customers, potentially attracting more customers who are interested in these additional offerings. It also allows Members to tap into new customer bases associated with BLUE HAWK and IMARK, as you gain access to each other’s inventory and can market and sell those products to your respective customer networks.

Grow With Your Fellow Cooperative Members

Ultimately, our goal is to increase your customers’ satisfaction, their loyalty to you, and increase order fulfillment. By partnering with fellow Members through buying and selling on FILL IT NOW, you can service more customers and offer more product categories without increasing expenses or inventory value. So why support an unaffiliated supplier when you can support your fellow cooperative Members?

FILL IT NOW is open to and FREE for all Members of BLUE HAWK and IMARK Plumbing! Members will be invited strategically over the remainder of the year, but if you are eager to onboard right away, please reach out to BLUE HAWK Director of Operations Jessica Jones or Marven Shook of the MarketPush team today.

2023 VENDOR PARTNER SCORECARD RESULTS

The 2023 Vendor Partner Scorecard rankings have been finalized and the results are in. Below are the Top 10 Vendor Partners in Overall Satisfaction as well as Sales, Product Quality, Service, Delivery and Pricing.

Our Members rank participating Vendor Partners on a scale of 1 – 10 for various metrics. These rankings are aggregated and individual ranking data remains anonymous, ensuring that Members are free to provide honest feedback.

Forty six Vendor Partners chose to participate in the 2023 VP Scorecard and our Members provided feedback on 2,672 relationships with those Vendor Partners.

One survey question asks each member to rate their Vendor Partner relationship relative to other suppliers in that product category. We’re happy to report that 72% of the Vendor Partner relationships were rated as an Above Average or Superior Performer.

Overall Ranking

- Gray Flex Systems, Inc.

- Southwark Metal Mfg. Co.

- Gray Metal Products, Inc.

- Ultravation, Inc.

- Nu-Calgon

- Gray Metal South

- Lucas-Milhaupt

- Panasonic Eco Systems

- Johns Manville

iO HVAC Controls (tie)

Sales Rep Performance

- Gray Flex Systems, Inc.

- Southwark Metal Mfg. Co.

- Ultravation, Inc.

- Gray Metal South

- Nu-Calgon

- Gray Metal Products, Inc.

- Panasonic Eco Systems

- MA-Line Specialty Products

- Johns Manville

- Mann+Hummel Air Filtration

Product Quality, Mfg. Capabilities

- Gray Flex Systems, Inc.

- Gray Metal Products, Inc.

- Arkema

- Ultravation, Inc.

- Panasonic Eco Systems

- Nu-Calgon

- Southwark Metal Mfg. Co.

- TracPipe by OmegaFlex

- Johns Manville

Gray Metal South (tie)

Service, Communication, Product Training

- Gray Flex Systems, Inc.

- Nu-Calgon

- Southwark Metal Mfg. Co.

- Ultravation, Inc.

- Gray Metal Products, Inc.

- Johns Manville

- Neuco

- Gray Metal South

- UEi Test Instruments

- iO HVAC Controls

Deliveries, Lead Times, Fill Rates, Errors

- Neuco

- Southwark Metal Mfg. Co.

- Gray Metal Products, Inc.

- Gray Flex Systems, Inc.

- iO HVAC Controls

- Lucas-Milhaupt

- Ultravation, Inc.

- TracPipe by OmegaFlex

- Thermo Manufacturing

- UEi Test Instruments

Pricing, Terms & Conditions, Profitability

- Gray Metal Products, Inc.

- Southwark Metal Mfg. Co.

- Gray Flex Systems, Inc.

- Lucas-Milhaupt

- UEi Test Instruments

- Gray Metal South

- Ultravation, Inc.

- Tigre USA

- Genesis

- Thermo Manufacturing

BLUE HAWK Social Media